Cheap mobile loans; Timiza loans app download and loan application

Timiza is a loan product from Barclays Bank of Kenya. This loan is available via mobile application. With the advent of paperless banking, mobile loans is the way to go. The beauty with mobile loans is that the loan processing is convenient and flexible.

With Timiza you can do your banking on your phone whether you want to open an account, get an instant loan, transfer funds or purchase insurance. But that’s not all. If you are already registered for Timiza, you can also save and earn high returns and great rewards with our Zidisha account.

Get started with Timiza

• Open an Account instantly.

• Save and earn rewards with Zidisha.

• Get instant loans on your phone.

• Deposit funds into Timiza.

• Purchase insurance.

• Buy airtime.

• Pay for KPLC/ZUKU/DSTV/GOTV bills.

What are the requirements for a customer to have a Timiza Account?

• Be a registered Safaricom Subscriber.

• Be a registered Safaricom M-PESA customer.

• Have an active Safaricom M-PESA account/line.

• Hold a Kenyan National Identification Document (ID) Kindly note that Kenyan passports are not allowed.

Timiza Tariff and Guides

Please refer to the Timiza Tariff and frequently asked questions on the link below:

Who is eligible for a Timiza Loan?

In order to qualify for a loan, you need to be an M-PESA subscriber for more than 6 months, actively use other Safaricom services such as voice, data and M-PESA. You will also need to have a good rating at the Credit Reference Bureau [CRB] and by Safaricom on Okoa Jahazi.

What are the features of the Timiza Loan?

• If you qualify, your loan limit will be displayed when you log in to your Timiza account and you can borrow.

• Timiza Loan attracts an interest charge of 1.083% charged once and a facilitation fee of 5% of the amount borrowed for a term of 30 days.

• Loan is disbursed to the Customer’s Timiza account (not directly to M-PESA). The Customer will access the funds by withdrawing from Timiza to M-PESA

• To grow your loan limit:

a. Increase activity on your TIMIZA Account by transacting on other services offered on Timiza. For example, Deposit cash, Purchase airtime, Pay your utility bills, Subscribe to Insurance.

b. Open and Increase savings on your Zidisha savings account on Timiza

c. Increase usage of M-PESA services

How to install the Timiza loan app

This loan app can be easily installed from Google play store. Just open Play store from your mobile phone, search for Timiza loan app and install it. With this you are good to go.

Also read;

- How to get the JumboPesa Plus Loan faster, easily and cheaply via your mobile phone

- How to get the Zidisha Loan faster, easily and cheaply via your mobile phone

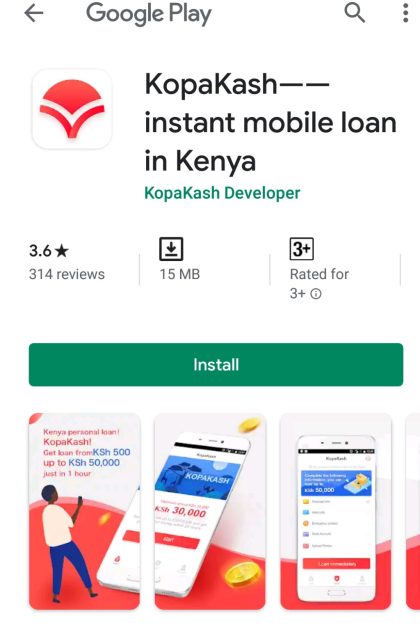

- How to get the KopaKash Loan faster, easily and cheaply via your mobile phone

- How to get the Tumiwa Loan faster, easily and cheaply via your mobile phone

- How to get the Africaloan Kenya Loan faster, easily and cheaply via your mobile phone

- How to get the StashfinLoan faster, easily and cheaply via your mobile phone

- How to get the Berry Loan faster, easily and cheaply via your mobile phone

- How to get the Zenka Loan faster, easily and cheaply via your mobile phone

- How to get the Jazika Loan faster, easily and cheaply via your mobile phone

- How to get the Opesa Loan faster, easily and cheaply via your mobile phone

- How to get the Okolea Loan faster, easily and cheaply via your mobile phone

- How to get the Pesa Zote Loan faster, easily and cheaply via your mobile phone

- How to get the Okash Loan faster, easily and cheaply via your mobile phone

- How to get the Saida Loan faster, easily and cheaply via your mobile phone

- How to get the Haraka Mobile Loan faster, easily and cheaply via your mobile phone

- How to get the Timiza Online Loan faster, easily and cheaply via your mobile phone

Need help

Emergency loan