The Kenya Revenue Authority, KRA, has re-introduced the Turnover Tax (TOT) which will be payable from 1st January 2020. This is in accordance with the Finance Act, 2019. If you are wondering what Turn Over Tax is, who should pay it and how to pay it; then get all the information here.

Who should pay Turnover Tax?

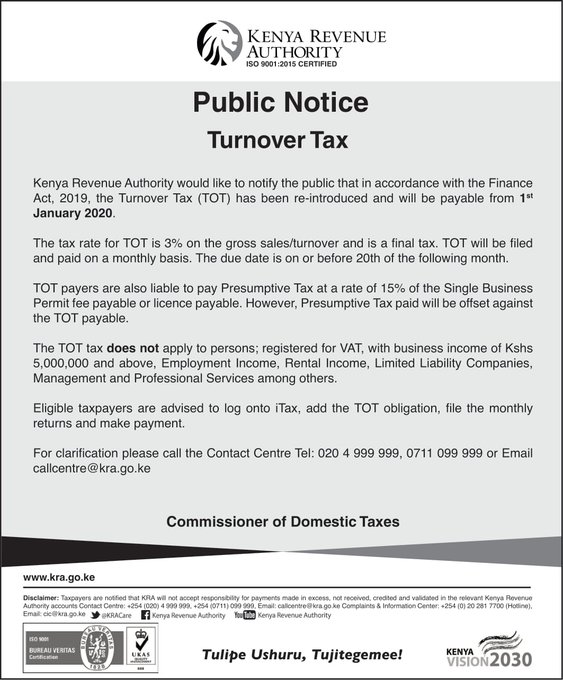

Turnover Tax (TOT) is payable by any resident person whose turnover from business does not exceed or is not expected to exceed Kshs 5,000,000 during any year of income.

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Portal

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

Who shall not pay Turnover Tax?

If you fall in the following categories, then you are exempted from paying the Turnover Tax:

- Persons registered for VAT

- Persons with business income of Kshs 5,000,000 and above,

- Employment Income,

- Rental Income,

- Limited Liability Companies,

- Management and Professional Services among others.

What is the rate for Turnover Tax (TOT)?

The tax rate for TOT is 3% on the gross sales/turnover and is a final tax.

Filing of TOT Returns

TOT will be filed and paid on a monthly basis. The due date is on or before 20th of the following month.

Note

TOT payers are also liable to pay Presumptive Tax at a rate of 15% of the Single Business Permit fee payable or licence payable. However, Presumptive Tax paid will be offset against the TOT payable.

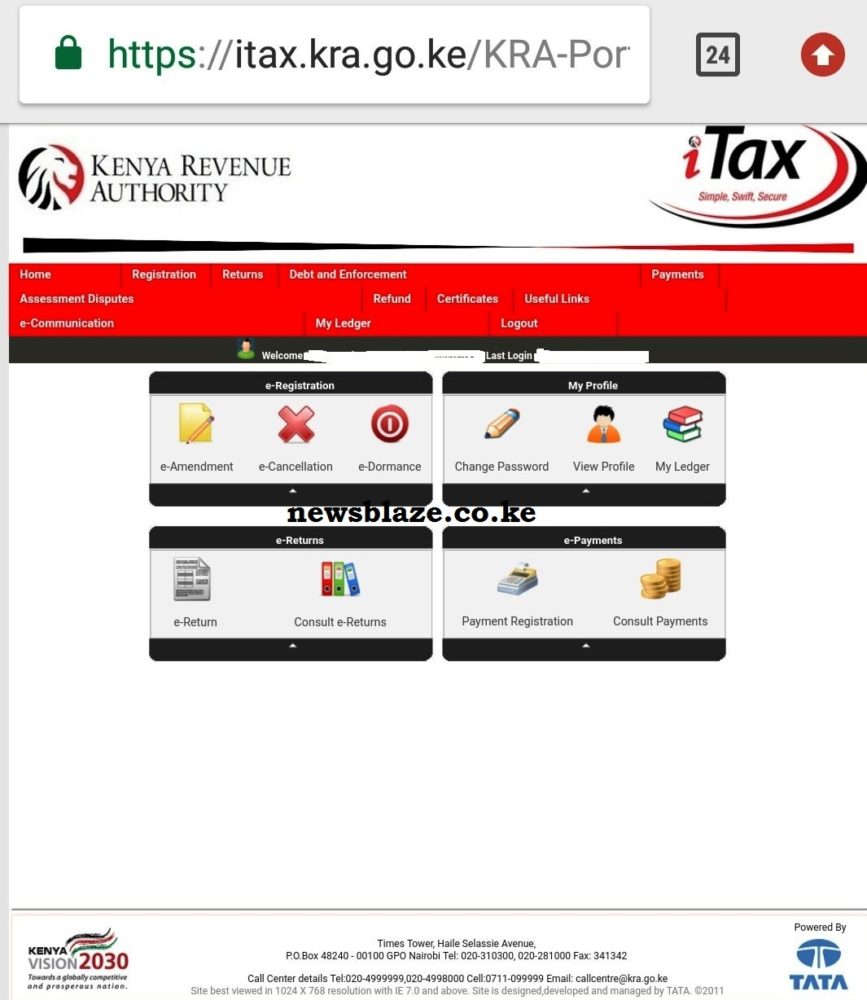

Eligible taxpayers are advised to log onto iTax, add the TOT obligation, file the monthly returns and make payment.

LIST OF ALL KRA TAXES

The links below provide complete information on all KRA taxes: