Kenya School of Revenue Administration (KESRA) is the Kenya Revenue Authority’s premier training school specializing in Tax and Customs Administration, Fiscal Policy and Management. The School is one of the only four World Customs Organization (WCO) accredited Regional Training Centres (RTCs) in Africa.

KESRA Academic Programmes

Certificate in Tax Administration

Requirements

Overview

This foundation course is designed to inculcate basic skills and knowledge required for entry into the Tax profession. Graduates of the KESRA Certificate in Tax Administration will have the requisite competencies to handle basic taxation for individuals and business enterprises

Duration

Mode of Study

To apply:

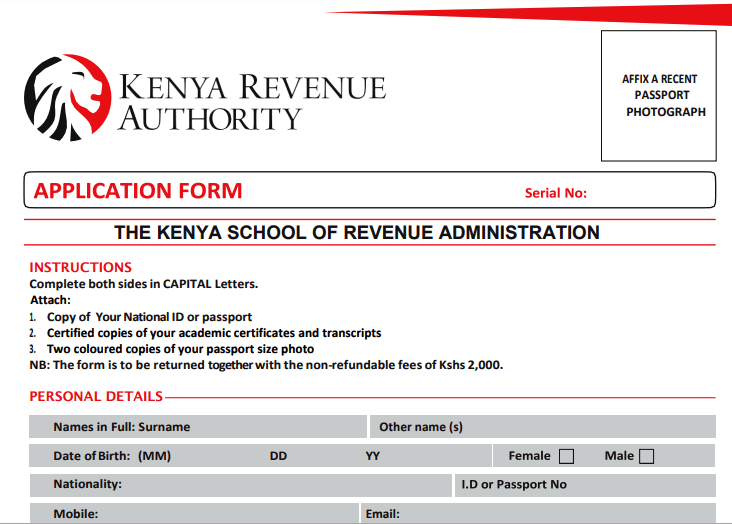

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Certificate in Customs Administration

Requirements

Overview

The clearing and forwarding sector plays a critical role in facilitating international trade and logistics, and is therefore an agent of economic development. In the East Africa Region, the sector plays an even more strategic role in the regional integration processes by providing essential services such as Customs clearance, warehousing and transportation. The course is designed to equip learners with the necessary technical skills and professional ethics to responsibly discharge their duties and responsibilities as Freight Forwarding Practitioners. It is critical in ensuring students understand managing transportation documentation, compliance with customs processes and regulations. The EACFFPC Certification is recognized in the East African region by all tax authorities.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Here are links to the most important news portals:

- KUCCPS News Portal

- TSC News Portal

- Universities and Colleges News Portal

- Helb News Portal

- KNEC News Portal

- KSSSA News Portal

- Schools News Portal

- Free Teaching Resources and Revision Materials

Diploma Programmes

Diploma in Tax Administration

Requirements

Overview

The dynamic and increasingly complex fiscal environment requires robust technical skills, knowledge and attitude in tax administration to manage emerging business, financial and economic environment. The KESRA Diploma in Tax Administration is designed to produce well-rounded graduates with the requisite capacity to effectively work in a Tax Administration, tax consultancy firms and audit firms the not-for-profit organizations, corporations and international responsibilities.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Diploma in Customs Administration

Overview

Requirements

This foundation course is designed to equip learners with basic skills, knowledge and attitude in Customs and its processes. Graduates of the KESRA Certificate in Customs Administration will gain knowledge about global operations of Customs and the requisite competencies to handle Customs Clearance and Freight Operations.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Diploma in Maritime Transport Logistics

Requirements

Overview

The Diploma Programme in Maritime Transport Logistics prepares students to build knowledge and skills in the Maritime Industry.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Postgraduate Programmes

Postgraduate Diploma in Tax Administration

Requirements

Overview

The Postgraduate Diploma in Tax Administration programme seeks to equip participants with skills, techniques and understanding required in the administration of Domestic Taxes in the private and public sectors of the economy. This programme will transform graduates in the disciplines of economics, business administration, finance, engineering, accounting, mathematics and law to tax administration professionals capable of working efficiently and effectively in a functionally-integrated tax authority as well as offer tax consultancy services to the public.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Postgraduate Diploma in Customs Administration

Overview

Overview

The Postgraduate Diploma in Customs Administration programme seeks to equip participants with skills, techniques and understanding required in Customs administration in the private and public sectors of the economy. It aims at supporting the integration and economic development of East African Community.

Duration

Mode of Study

To apply:

- Download the Application form by clicking on the Apply button.

- Fill and submit the application form at Times Tower 8th Floor or KESRA Centre Westlands.

Masters Programmes

Master’s in Tax Administration (with specialization in Tax or Customs)

Overview

This programme is an innovative and specialist graduate programme designed to impart advanced knowledge of major technical, conceptual and research issues in the areas of tax and customs administration and provide training in the practical and procedural aspects.

Duration

Mode of Study