Best insurance policies; The CBA Luxmed Insurance policy

Insurance policies come in handy during difficulty periods. There are policies that give compensations during medical fee expenses, deaths and accidents among many others.

The Commercial Bank of Africa, CBA, Luxmed is a unique insurance product for individuals, employees working in their companies, family members and groups. It offers an Inpatient Cover, Accidental Death cover and an inbuilt Last Expense cover.

This is a group cover where the minimum number of members under a group is 5, with a group identified as individuals who have come together for a purpose other than obtaining insurance.

Benefits

Inpatient Cover

This is a health care plan to manage unforeseen illness or injuries that lead to hospitalization.

Accidental Death Cover

This provides compensation to the insured family/ beneficiary in the event of physical and visible body injury leading to death within 6 months from the date of the accident.

Last Expense

This cover provides support to cover funeral expenses following the death of the insured.

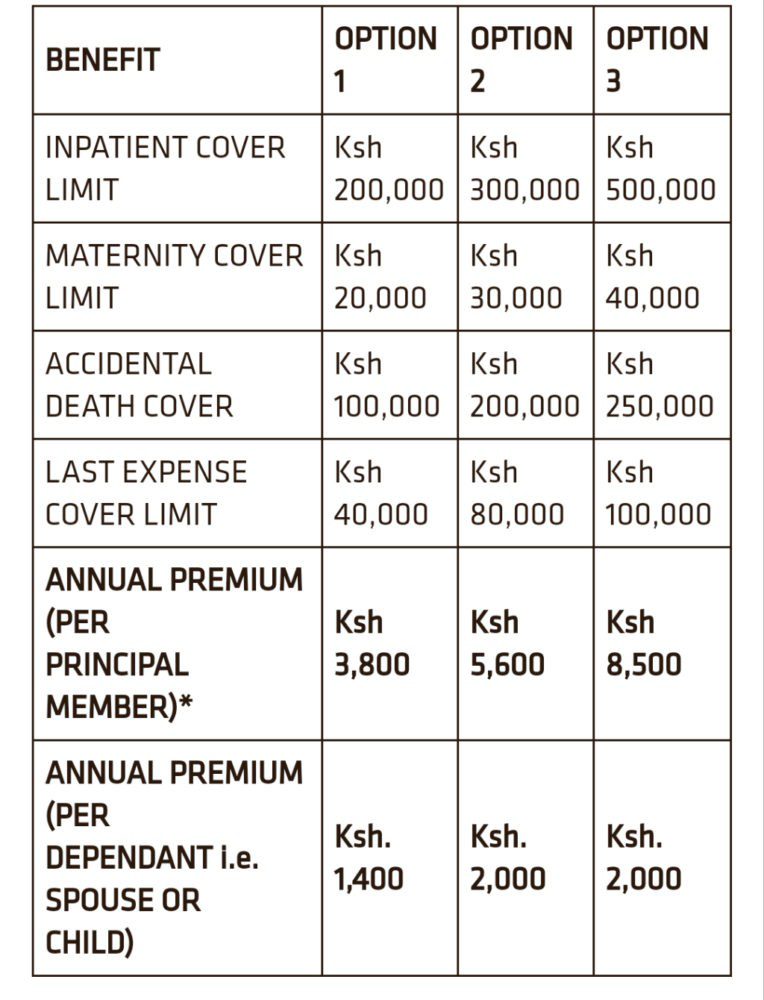

Cover Benefit Options

To apply, you need the following;

1). Completed application form

2). National ID copy and KRA Pin for each principal member

3). Passport size photos of principal member and dependents

4). Proof of schooling for children between 18-24 years old.

For clarification/ details use these contacts;

1). Tel: +254 20 2884444Mobile: +254 711 056444+254 732 156444Fax: +254 20 2734616

2). Email: [email protected]

Also read;

List of Services provided by AMACO insurance, how to get them online and contacts