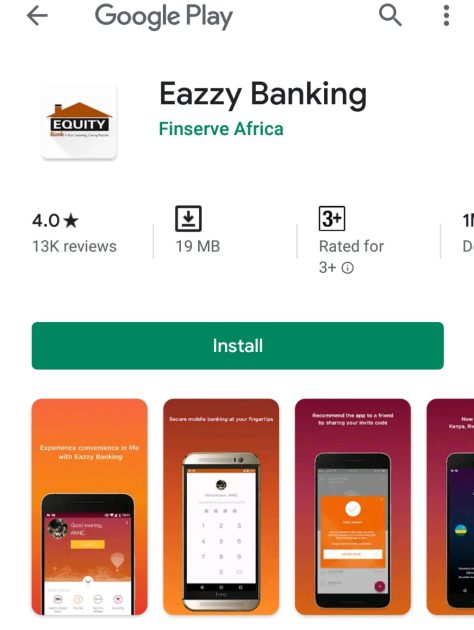

Equity’s Eazzy banking mobile App: Get mobile loans easily and quickly

Mobile loans have become more popular for customers seeking quick loans. Unlike over the counter loans, mobile loans offer convenience and flexibility. Take for example if one had an emergency; that requires financial attention, over the weekend and on public holidays when most banking halls are closed! Such an individual will suffer a great deal. But thanks to mobile loans Apps, one can process the loans online and instantly. All what is required is a smart phone and you will get your loan instantly. Furthermore, mobile loans are paperless and thus very few requirements, if any, are needed. Again, there so many lenders providing loans online. The Mobile lenders have developed Apps that can be downloaded freely from Play Store. Here is one of the lenders providing such loans online.